MedTech Founders: The $6.4B Wake-Up Call for 2025

- Apsis cg

- Oct 16

- 2 min read

The AI Premium Is Real (and Growing)

For the first time on record, AI-enabled startups captured 62% of all digital health funding—nearly $4 billion of the total pot. The premium is brutal: AI-enabled companies average $34.4 million per round compared to $18.8 million for non-AI teams. That's an 83% funding premium for demonstrable AI integration.

Nine of eleven mega-deals ($100M+) went to AI-enabled startups. Companies like Abridge raised $550 million across two mega rounds in four months, while Truveta launched with $320 million. This isn't speculation capital—it's validation capital flowing to teams proving workflow ROI and clinical impact.

The Operational Proof Mandate

Investors have moved from "AI-curious" to "AI-demanding" with concrete requirements:

Model Maturity: Show your AI moves beyond basic alerts to measurable workflow improvements. Ambient documentation tools are achieving 30-40% adoption rates across physician groups, with leading hospitals reporting 90% utilization.

Data Advantage: Prove you can lock up proprietary data sources or establish network effects that create competitive moats. Large-cap investors are specifically betting on companies that control data access before reimbursement pressures intensify.

Clinical ROI: Document real-world evidence of cost reduction, outcome improvement, or efficiency gains. The Peterson Health Technology Institute notes that ambient scribes represent "the first large-scale application of generative AI in health systems".

The Regulatory Reality Check

While AI captures headlines, regulatory strategy determines exits. The consolidation toward fewer, larger deals means investors expect teams to front-load regulatory clarity from concept phase.

Three regulatory priorities dominate 2025 investment decisions:

Cybersecurity compliance: FDA now mandates comprehensive security measures for connected devices. Teams demonstrating SOC 2 Type II and HIPAA/HITECH audits from Day 1 command investor confidence.

AI transparency requirements: Both FDA and EU AI Act enforcement (August 2026) demand explainable AI models with clear audit trails and bias mitigation.

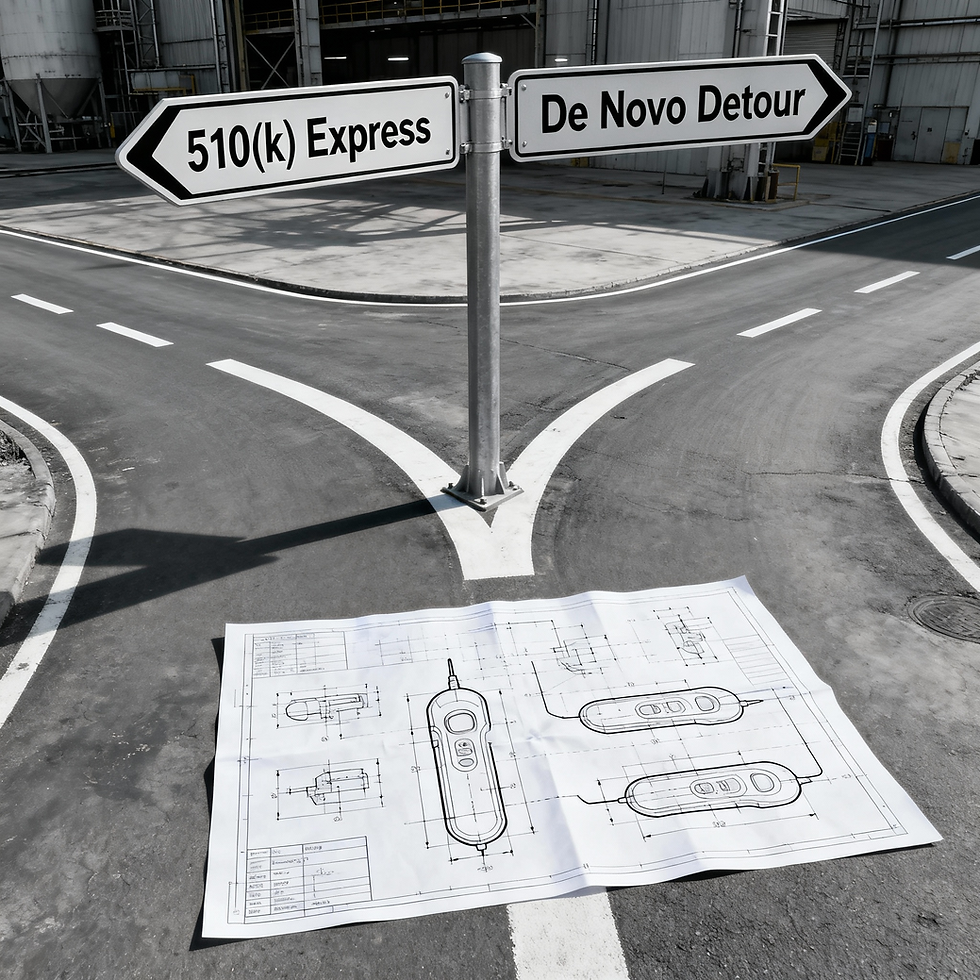

Pathway precision: Investors price regulatory risk more carefully post-ZIRP. Teams with concrete 510(k), De Novo, or breakthrough designation strategies get funded. Those with "we'll figure it out" regulatory plans get passed over.

Bottom Line: Operational Proof Beats Pitch Decks

The H1 2025 data reveals a fundamental shift from promise-driven to proof-driven investment. Teams raising premium rounds share two characteristics: measurable workflow impact and regulatory clarity that de-risks the path to market.

For founders still building: Focus on live deployments that generate adoption metrics before your next fundraising cycle. Document savings, efficiency gains, and clinical outcomes with the same rigor you apply to product development.

For those fundraising now: Lead with operational proof, not technology demos. Investors want to see how your solution integrates into existing workflows, what barriers you've overcome, and how you've de-risked regulatory approval.

Comments